Trailblazing products, technology and support help you enjoy a Stand-Out Benefits Experience today & tomorrow.

We’re blazing new trails to help you reach new heights with ancillary benefits.

More and more employers are seeing the power of ancillary benefits. They’re becoming pivotal in the race to acquire and retain the quality talent you depend on to propel your business forward.1

But their value to job candidates and employees is only as good as the products themselves and the team and tools behind them. This is no place for carriers that treat ancillary benefits as an afterthought.

Delivering exceptional ancillary benefits and an equally compelling benefits experience has been our focus at Renaissance since day one. Today, our trailblazing products, technology and support are all part of our ongoing commitment to ensure your ancillary benefits offering and experience Stands Out today and tomorrow.

78% of employees

are more likely to stay with their employer because they appreciate the benefits program offered2

Lead the way with benefits that set you apart. The right benefits package is a powerful tool for keeping employees engaged, motivated and loyal to your organization. Investing in dental, vision, life, and disability insurance isn’t just about caring for your team—it’s about protecting your bottom line.

Trailblazing Benefits That Take Your Business Further

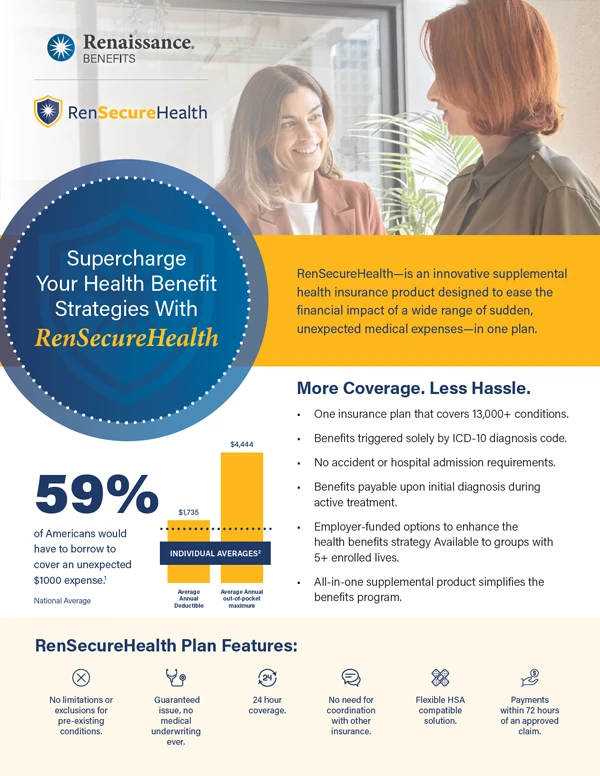

Bridge the gap in healthcare coverage with RenSecureHealth

When nearly 6 in 10 Americans would need to borrow money to cover a $1,000 medical expense,* offering RenSecureHealth can make a real difference. This innovative supplemental plan provides quick cash benefits for 13,000+ illnesses and injuries — helping employees recover faster, financially and physically.

*Lane Gillespie, Tori Rubloff. “Bankrate’s 2025 Annual Emergency Savings Report,” March 26, 2025

Three Groundbreaking Ways Renaissance Delivers a Stand-Out Benefits Experience

Your Go-To Resource for Success

Take a few moments to briefly review a sampling of the complimentary resources we provide you and your employees. You’ll quickly see we’re all about helping you spend less time dealing with ancillary benefits, while helping your employees get the most out of them.

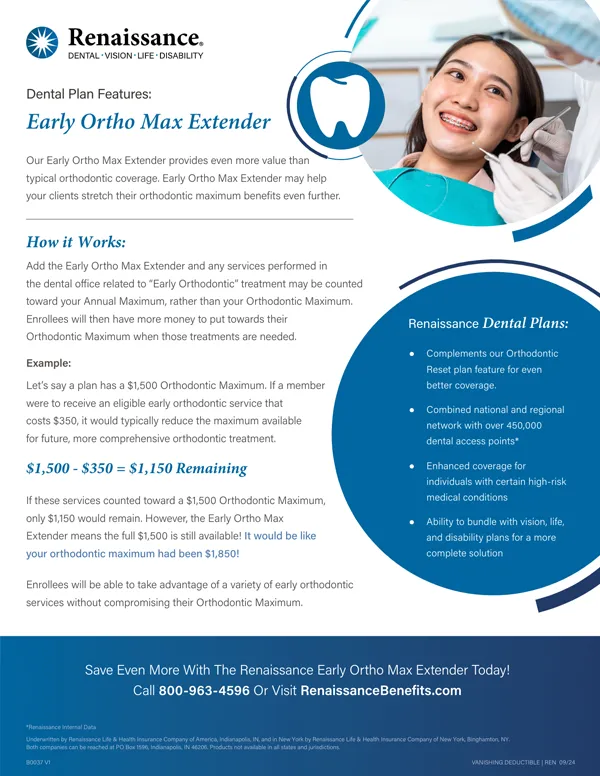

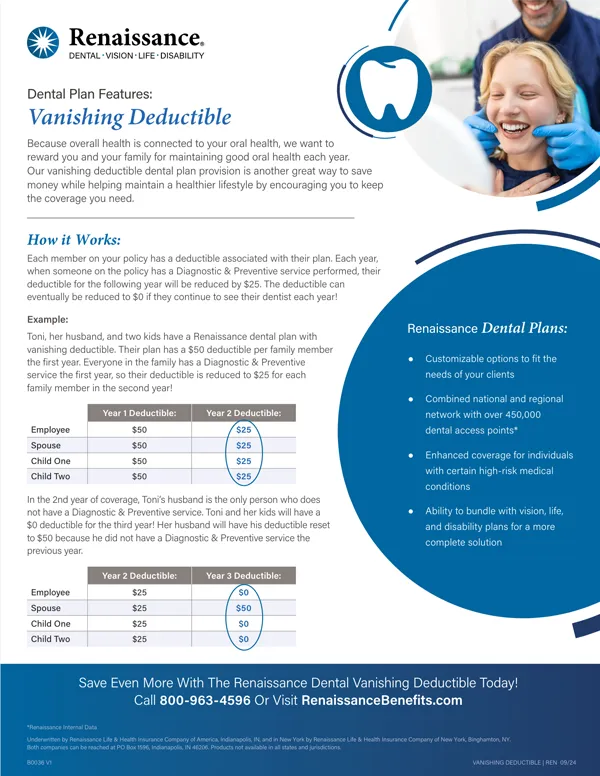

Innovative Products & Services

Employer Guides

Discover More About Us By Watching These Video Highlights

RenSecureHealth Overview

RenConnect – Technology & Innovation

Our Vision – Message from CEO Diana Steinhoff

Service and Company Overview

Heart of the People

1 Buck, a Gallagher company. “2024 Welbeing and Voluntary Benefits Survey” Feb. 2024.

2 Willis Towers Watson. “Employer and employee satisfaction with group benefit marketplaces.” Sept. 2018.